Event Details

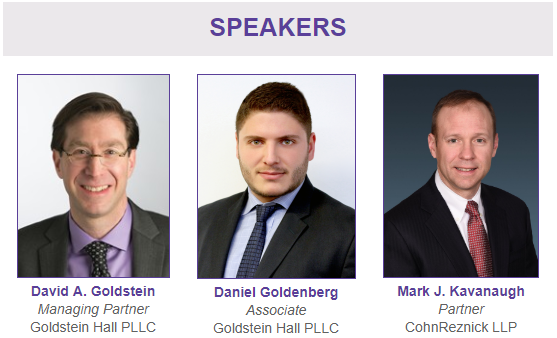

Webinar: The Emerging Issues In The Expiring-Use Affordability Crisis Presented by Goldstein Hall & CohnReznick

Wednesday, March 6th, 2019

Webinar : 11:00am - 12:00pm

Join Goldstein Hall and CohnReznick for a discussion about the rights an investor partner has in a Low-Income Housing Tax Credit project and how those rights CAN be exercised to protect its investment, profit and control of the project – whether exiting or remaining after Year 15.

Topics include:

- The statutory framework underlying Low-Income Housing Tax Credit projects, including the tax principles underpinning such projects.

- The strategies an investor partner has to maintain its value and control in a Low-Income Housing Tax Credit project.

- How to pre-empt the concerns a not-for-profit partner may have when Year 15 approaches and the investor partner prepares to exit.

- What an investor partner should consider when a potential offer to purchase is made or the project’s owner requests the sale of the project’s property.

- Recent legal developments

REGISTER HERE